2019 was a great year, in 2020 when Covid hit, many thought that would trigger the real estate market correction which some thought had been long overdue; NOPE! With Covid, people decided that they wanted more space, less neighbors and to house-up. With working from home being the new norm, the only thing that matters on house criteria is fast internet.

To add hurt to injury 18 months of historical low interest rates under 3% have let buyers overpay for houses.

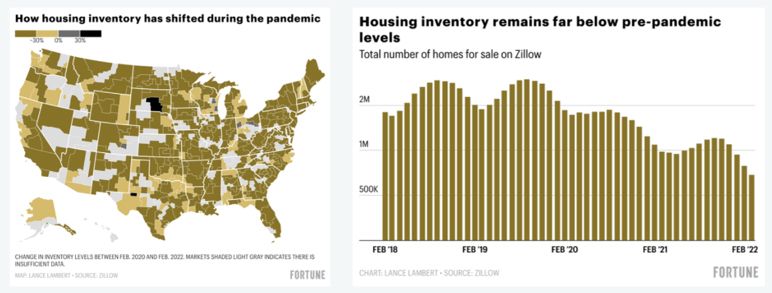

Many had health concerns with Covid and therefore sellers did not want a lot of strangers in their house. So as the demand spiked, the inventory dropped; welcome to the perfect storm.. Two years post Covid, as more and more people are vaccinated, it was anticipated that inventory would increase.

In addition to this, with the end of Forbearance (Government mortgage assistance for people impacted by Covid) last year, it was thought that there would be an immediate inventory injection of very motivated sellers: wrong again!

Most thought that low inventory issues would tamper down as Covid began to normalize, especially as home prices and interest rates continue to rise; but instead, we have 30% less inventory than a year ago, how can this be?

The first and main reason is demand. Millennials are now in their 30’s and had been on the sidelines unusually long compared to their elder generations. Now that their careers are hitting second and third tiers and their finances are becoming more secure, they feel more comfortable with buying.

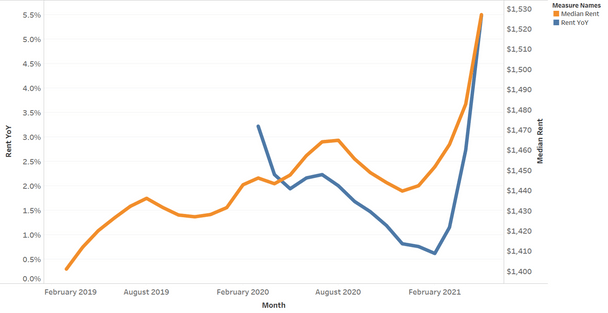

Another big motivator is that rent prices are also sky-rocketing; if your mortgage is less than your rent, the price of the house doesn’t really matter.

Ever since 2008 builders have been scaling back new construction. Even though we have been in the longest real estate up trend in history, builders have been hopefully cautious the entire time. Only last ear did new build permits exceed the 2006 peak.

There are now more real estate investors than ever, and rightfully so, real estate is a very safe investment avenue; hedged against inflation, not subject to outside factors like the stock and bond markets; you get to benefit from cash flow, debt pay down (with someone else’s money), writing off interest, repairs and depreciation. The only chance first time home buyers have against investors is to call expert agents; like me and my team!

Last but not least, rising interest rates should be a turn off for buyers but instead it has created a massive sense of urgency. We need to buy NOW before the interest rates keep on rising!’ With low unemployment and strong salary increases buyers can absorb several more increases in rates…

The historical average is 7.2%, so these rates are still quite low, all things considered.

What does all this mean? There is no end in sight, we can expect more of the same for the foreseeable future. So whether you are thinking about buying, selling or investing; give us a call and let us help you accomplish all your goals!